Financial Planning

We help you plan for success based on your unique needs.

Our financial planning process is an in-depth review of our client’s financial needs, goals, and challenges. Once we have identified the opportunities for growth and sustainability, we can create a tailored financial planning strategy for a tax-efficient retirement. The work done with the client and the planner sets the stage for the greatest possibility for the client to reach his or her financial goals in the near and long-term.

WATCH: The Financial Planning Process and Tools

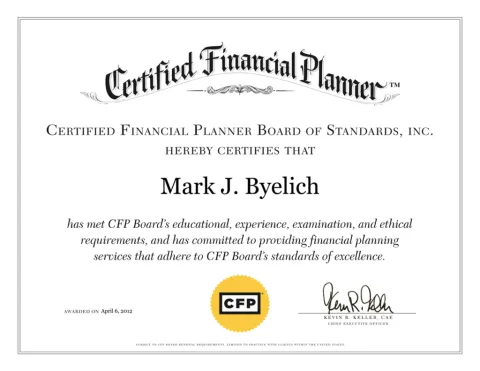

Why You Should Choose a Certified Financial Planner™ Practitioner.

As a Certified Financial Planner ™ Practitioner, Mark Byelich must adhere to the Code of Ethics and Standards of Conduct put forth by the Certified Financial Planning Board of Standards. The Code of Ethics is listed below. Visit the CFP Board’s website to review the Code of Ethics and Standards of Conduct:

- Act in the client’s best interests.

- Act with honesty, integrity, competence, and diligence.

- Act in a manner that reflects positively on the financial planning profession and CFP® certification.

- Exercise due care.

- Avoid or disclose and manage conflicts of interest.

- Maintain the confidentiality and protect the privacy of client information.

- Act in a manner that reflects positively on the financial planning profession and CFP® certification.

Mark Byelich, CFP®, AIF®

Zero-Tax Strategies

We believe our country’s fiscal challenges will result in significantly higher taxes in retirement. We show our clients how to save and shift their assets to be tax-efficient and sometimes achieve the 0% tax bracket in retirement. As a member of David McKnight’s Elite Power of Zero Advisor Group, Mark Byelich is trained and dedicated to helping his clients achieve a tax-efficient retirement plan.

Financial Planning

Our financial plans address the “what-if’s” that may occur in your retirement. We construct tax-efficient income streams that can help you reach the zero-tax income bracket when you reach retirement.

Investments

Investments Investments Investments-There are so many options. We focus on finding the best, low-cost options to help you to meet your needs. We have a special approach that is designed to help protect your hard-earned money while allowing for the growth you need to live on in the future. We do it differently than most, find out how.

Insurance

Life Insurance, Long-Term Care, Disability Insurance, Property & Casualty Insurance — Insurance can be complicated. We will help you determine what is best for you.